Quick History:

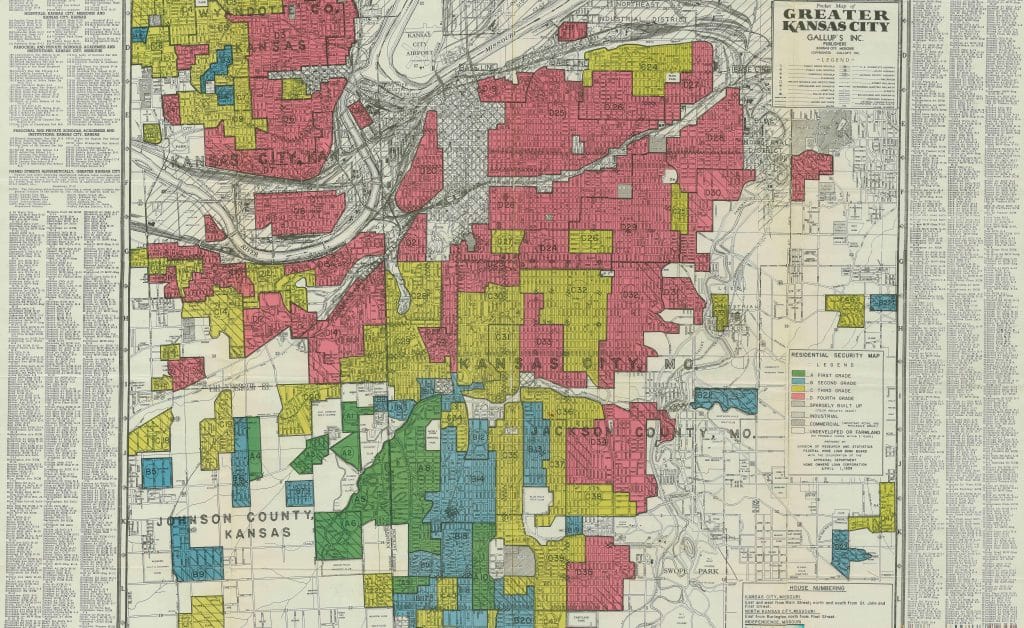

In 1934 the United States Government begins to regulate the mortgage industry and implements the National Housing Act. This act made it necessary to determine whether a certain area was fit for investment by banks and other providers of credit. Areas with a high population of black Americans were deemed as not fit for investment. This resulted in fair lending vehicles not being provided to either purchase, improve, or fix property in these areas. If a loan was available, often it was predatory and it cost more than the value of the home.

Impact:

Home ownership makes up such a vast portion of wealth in the lives of American families that it alone can explain the massive differences in wealth between black and white Americans. Your home is likely the largest purchase that you will make in your lifetime. For nearly 40 years Black Americans were locked out of loans enabling them to purchase a home, an asset capable of being leveraged while it appreciated. Not only were loans used to purchase a home inaccessible to Black Americans, but inaccessibility to loans to fix or improve existing homes limited their ability to protect/enhance their investments. This purposeful set of events severely reduced Black Americans ability to generate and pass on wealth.

Next Steps:

Identify methods for your family to create and pass on wealth. Life Insurance, Home Ownership, Small Business, and Education Investments are efficient ways to transfer wealth.